Online Banking With Us

Join us and benefit from our many loans and services available only to our valued members.

Always Be Fraud Aware

Join us and benefit from our many loans and services available only to our valued members.

Kildare Credit Union will NEVER contact an individual member by phone, text, or email asking them to click a link to verify their account or give personal account details over the phone. If a member of the public does receive such a call, text message, or email they are advised NOT to give any account details to the caller or to click on the link under any circumstances.

Keep your account and log in details safe and secure. NEVER share your log in credentials with anyone, regardless of who they may claim to be.

Fraudsters can use Number Spoofing when they make contact by phone to make it look like they are calling from the phone number of a genuine organisation. They may then try to trick the person into divulging personal, financial or security information. Remember: Scams can take many formats.

Fraudsters are very good at making e-mails look genuine and can set up elaborate and convincing dummy websites. NEVER click on links in messages. Always manually enter a web address into the address bar of your browser.

If a member of the public is in any doubt about any message that they receive in relation to their credit union account, please contact us directly on 045-521928 or email info@kildarecu.ie.

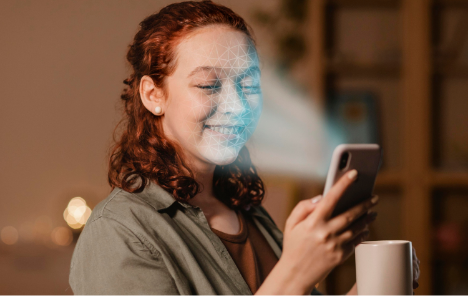

PSD2 - Strong Customer Authentication (SCA)

The European Union (Payment Services) Regulations 2018 (PSD2) were transposed into Irish law on 13 January 2018 and are applicable to Credit Unions when providing electronic payment services, for example, credit transfers, standing orders, direct debits and debit cards.

Credit Unions (along with other financial institutions) are Payment Service Providers (PSPs) and PSD2 places several obligations on PSPs providing payment services.

Its main objective is to reduce fraud and make online payments more secure. Therefore, under SCA, when accessing your account, you will have to authenticate yourself to the required legal standard before completing any transactions online. For example, SCA requires customer authentication based on the use of 2 or more elements below;

Knowledge - Something I know

- Password

- Pin

- Passphrase

- Swiping Path

Possession - Something I have

- Mobile Device

- Smart Card

- Token

Inherence - Something I am

- Fingerprint

- Voice

- Iris

- Facial

One of the above elements is known as single factor authentication. Two of the above elements is known as dual factor authentication.

Kildare Credit Union will use the following dual factor authentication;

- Pin - Knowledge - something I know

- Mobile device - Possession - something I have

SCA will be used when you carry out any of the following actions using your online account (the below are examples only and this list is not exhaustive):

- Accessing your account using PCS, Tablet Mobile, Apps

- Initiating a payment online

- Setting up a new payee

- When accessing accounts at least every 90 days

- Accessing online account data more than 90 days old

- Online transactions

- Statement history

- Transaction log

SCA is a mandatory legal obligation and all online users will be required to complete SCA to the legal standard we require.

For further information please see our Framework Contract and Website Security Terms which govern these types of transactions.

SEPA payments

If you wish to transfer funds into your account, then the payment should be made as a SEPA payment only. If you are aware that a third party is making a payment into your account, it is advisable they tell their financial institution the payment should be made via SEPA. If a payment is sent in any other way, the payment will be rejected by our processing bank and the Payer may incur a rejection charge that he/she may be liable for.

SEPA stands for Single Euro Payments Area, and a SEPA payment is sent through the SEPA scheme. The scheme was created to simplify euro transfers between EU member states, as well as a number of non-EU countries, in a fast, safe and efficient way, just like national payments.

The SEPA region consists of 36 European countries, including several countries which are not part of the euro area or the European Union.

To make a SEPA payment you need:

- The IBAN of the person you want to pay

- The bank to which you are sending the payment to be a member of the SEPA scheme

- The payment to be in eurou want to pay

Still have questions?

See if they're answered in our FAQs below

You can fill out the form here, and a member of staff will contact you to verify your identity and re-issue a PIN.

Click on the LOGIN button from the Online Banking menu to access your account. You will be asked for your member number, your date of birth and 3 digits out of your PIN to login to the member area. Within the member area, where it says Online Banking, click on LAUNCH NOW. You will be asked for 3 digits out of your PIN again to access your account.

SCA stands for Strong Customer Authentication. It is one of the regulations under the Revised Payment Service Directive (PSD2). It states that a customer must verify their identity before payment information can be exchanged between a financial institution. SCA will be triggered at certain event types, such as when downloading a statement.

SCA codes are automatically sent to the Kildare Credit Union Mobile App. If you do not yet have the Mobile App downloaded, when prompted, click where it says “Click here if you do not want to install the mobile app or do not have a smart device”. You will then get the option to download the Mobile App or receive a text with the SCA code.